Bitcoin Halving 2028 Countdown

00

Days00

Hours00

Min.0

Sec.Bitcoin Halving Epoch Progress: %

- Next Halving (ETA): loading...

- Current Block: loading...

- Halving at Block: loading...

- Blocks Left: loading...

- Halvings So Far: loading...

- Halvings Remaining: loading...

- Current Reward: loading... BTC

- Mined Per Day: ~loading... BTC

- Reward After Halving: loading... BTC

- Per Day After Halving: ~loading... BTC

- Circulating Supply: loading... BTC

- Left To Mine (Total): loading... BTC

Table of Bitcoin Halving Dates

| Halving # | Date | Block Height | Reward Before (BTC) | Reward After (BTC) |

|---|---|---|---|---|

| 1 | 2012-11-28 | 210,000 | 50 | 25 |

| 2 | 2016-07-09 | 420,000 | 25 | 12.5 |

| 3 | 2020-05-11 | 630,000 | 12.5 | 6.25 |

| 4 | 2024-04-20 | 840,000 | 6.25 | 3.125 |

| 5 | 2028 | 1,050,000 | 3.125 | 1.5625 |

| 6 | 2032 | 1,260,000 | 1.5625 | 0.78125 |

| 7 | 2036 | 1,470,000 | 0.78125 | 0.390625 |

| 8 | 2040 | 1,680,000 | 0.390625 | 0.1953125 |

| 9 | 2044 | 1,890,000 | 0.1953125 | 0.09765625 |

| 10 | 2048 | 2,100,000 | 0.09765625 | 0.04882813 |

| 11 | 2052 | 2,310,000 | 0.04882813 | 0.02441406 |

| 12 | 2056 | 2,520,000 | 0.02441406 | 0.01220703 |

| 13 | 2060 | 2,730,000 | 0.01220703 | 0.00610352 |

| 14 | 2064 | 2,940,000 | 0.00610352 | 0.00305176 |

| 15 | 2068 | 3,150,000 | 0.00305176 | 0.00152588 |

| 16 | 2072 | 3,360,000 | 0.00152588 | 0.00076294 |

| 17 | 2076 | 3,570,000 | 0.00076294 | 0.00038147 |

| 18 | 2080 | 3,780,000 | 0.00038147 | 0.00019073 |

| 19 | 2084 | 3,990,000 | 0.00019073 | 0.00009537 |

| 20 | 2088 | 4,200,000 | 0.00009537 | 0.00004768 |

| 21 | 2092 | 4,410,000 | 0.00004768 | 0.00002384 |

| 22 | 2096 | 4,620,000 | 0.00002384 | 0.00001192 |

| 23 | 2100 | 4,830,000 | 0.00001192 | 0.00000596 |

| 24 | 2104 | 5,040,000 | 0.00000596 | 0.00000298 |

| 25 | 2108 | 5,250,000 | 0.00000298 | 0.00000149 |

| 26 | 2112 | 5,460,000 | 0.00000149 | 0.00000075 |

| 27 | 2116 | 5,670,000 | 0.00000075 | 0.00000037 |

| 28 | 2120 | 5,880,000 | 0.00000037 | 0.00000019 |

| 29 | 2124 | 6,090,000 | 0.00000019 | 0.00000009 |

| 30 | 2128 | 6,300,000 | 0.00000009 | 0.00000005 |

| 31 | 2132 | 6,510,000 | 0.00000005 | 0.00000002 |

| 32 | 2136 | 6,720,000 | 0.00000002 | 0.00000001 |

| 33 | 2140 | 6,930,000 | 0.00000001 | 0.00000000 |

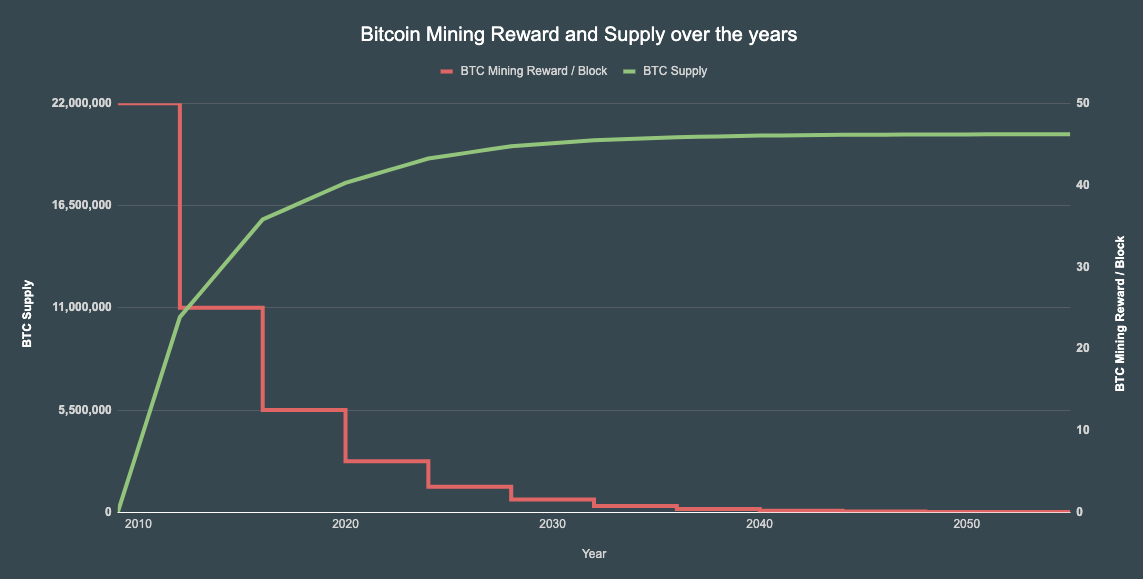

The last Bitcoin (or rather, the last satoshi) will be mined in the year 2140, just before the 33rd halving. At that point, the block reward will drop to zero.

Frequently Asked Questions About Bitcoin Halving

What Is Bitcoin Halving?

Bitcoin halving is a scheduled event that reduces the reward for mining and verifying new blocks by 50%. This means miners earn only half the number of BTC per mined block. Halvings occur every 210,000 blocks, roughly every four years, and continue until Bitcoin reaches its maximum supply of 21 million BTC.

What Happens When Bitcoin Halves?

When a Bitcoin halving occurs, the block reward is cut in half, reducing the rate at which new BTC are created. This effectively lowers Bitcoin’s inflation rate and enforces its controlled supply model, ensuring that the total supply never exceeds 21 million BTC.

Why Do Halvings Occur Slightly Earlier Than Every Four Years?

Bitcoin's mining algorithm targets a block time of approximately 10 minutes, but actual block times can vary. Some blocks are mined faster than 10 minutes, which can accelerate the timeline to the next halving. Due to this variation, the next halving is expected to take place in 2028.

When Is the Next Bitcoin Halving?

The last Bitcoin halving occurred on April 20, 2024, at 12:09 AM UTC. The next halving is projected to happen around April, 2028, when the network reaches a block height of 1,050,000.

These estimates are constantly updated as new blocks are mined. The closer we get to the event, the more accurate the prediction becomes.

Will Bitcoin Halving Increase BTC’s Price?

Historically, Bitcoin halvings have often been followed by price increases. For example, after the April 2024 halving, Bitcoin saw slight positive price movement. However, past performance is not a guarantee of future results. Market trends, demand, regulations, and overall crypto adoption all play a role in Bitcoin’s price movement.

This is not financial advice. Always conduct your own research before investing in cryptocurrency.

How Does Bitcoin Halving Affect the Price of Bitcoin?

For investors: Halving reduces the rate at which new BTC are issued, increasing scarcity. Historically, this has led to positive market sentiment and price appreciation, as seen with the 2020 halving when Bitcoin’s price rose 40% leading up to the event and later reached an all-time high of $67,000.

For miners: Halving reduces mining rewards, which can make operations less profitable. Miners with high operational costs may shut down, leading to a drop in Bitcoin’s hashrate. If Bitcoin’s price rises, some miners may return as profitability improves.

What Does This Page Do?

This tool tracks the Bitcoin blockchain in real-time and provides an accurate live countdown to the next halving event. It continuously updates to reflect the latest state of the network.

How Often Does This Page Update?

This page updates automatically with each new block mined. Unlike static countdowns, it dynamically adjusts based on real-time blockchain data, ensuring the most accurate estimate of the next halving event.

Why Is Bitcoin Halving Important?

Scarcity & Value: By reducing the issuance rate of new BTC, halving reinforces Bitcoin's scarcity, often leading to increased demand and price appreciation over time.

Deflationary Nature: Since millions of BTC are permanently lost due to lost keys and inaccessible wallets, halving further enhances Bitcoin’s deflationary nature.

Network Security: Miners validate transactions and secure the network. While block rewards decrease over time, mining remains an incentive-driven activity that ensures blockchain security.

What Happens When All Bitcoins Are Mined?

Bitcoin’s total supply is capped at 21 million BTC, expected to be fully mined by the year 2140. Once all BTC are mined, miners will be compensated through transaction fees paid by network users instead of block rewards.

How Does Halving Affect Bitcoin Miners?

Since halving reduces miners' rewards in BTC, it forces them to optimize costs by seeking cheaper electricity, using more efficient equipment, or shutting down operations. While this creates short-term challenges, it drives innovation, making Bitcoin mining more energy-efficient and decentralized in the long run.

Who Controls Bitcoin’s Issuance?

Bitcoin issuance is controlled by the network through a decentralized consensus mechanism. The core rules governing Bitcoin’s supply include:

- A maximum of 21 million BTC will ever exist.

- Blocks are mined approximately every 10 minutes.

- Halving occurs every 210,000 blocks (roughly every 4 years).

- The initial block reward was 50 BTC and continues halving until it reaches 0 BTC (around the year 2140).

Any change to these parameters would require network-wide consensus among all Bitcoin participants.